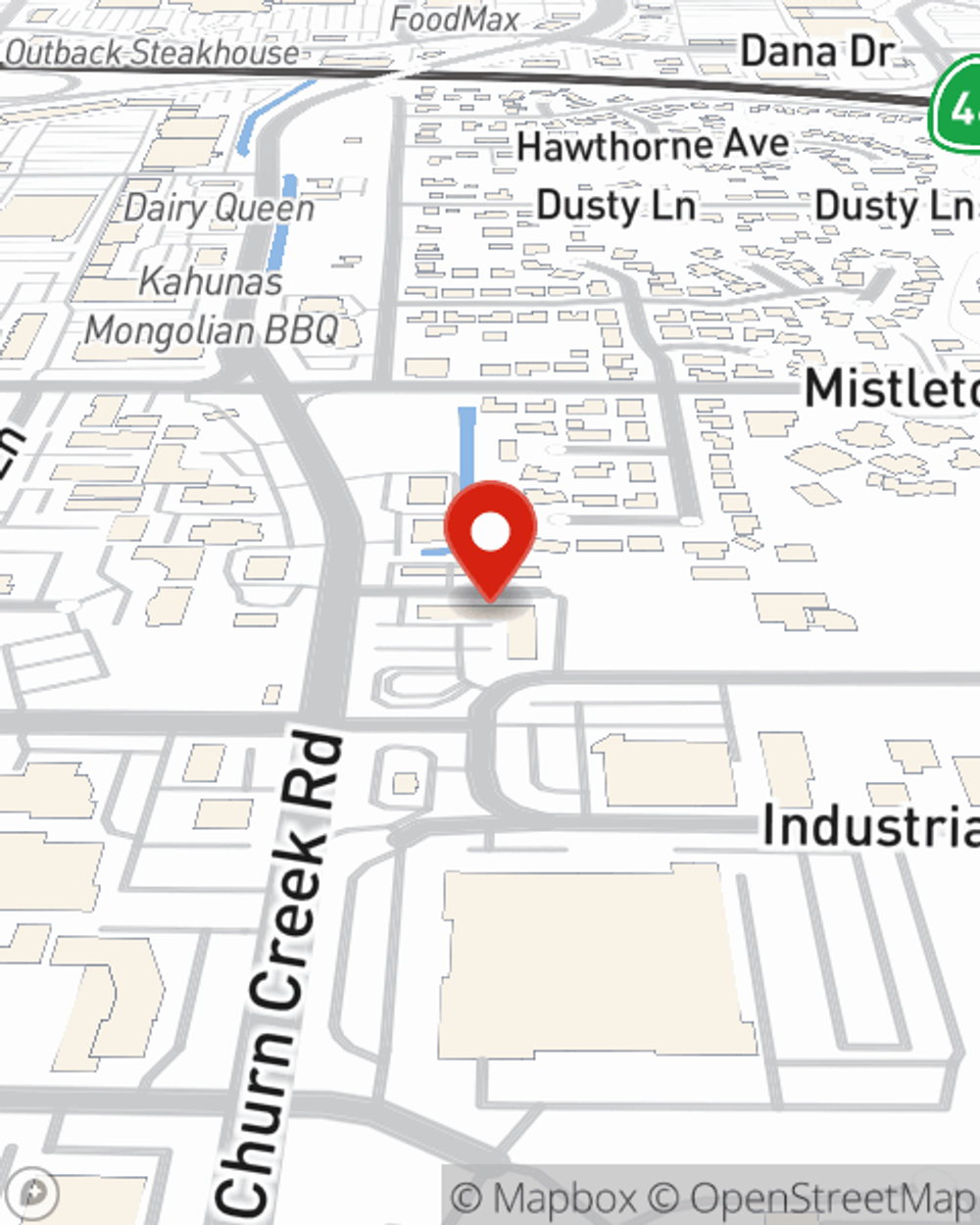

Business Insurance in and around Redding

One of Redding’s top choices for small business insurance.

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Spencer Lane help you learn about excellent business insurance.

One of Redding’s top choices for small business insurance.

This small business insurance is not risky

Small Business Insurance You Can Count On

Whether you are an optician a plumber, or you own a bicycle shop, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Spencer Lane can help you discover coverage that's right for you and your business. Your business policy can cover things such as equipment breakdown and loss of income and extra expense.

It's time to call or email State Farm agent Spencer Lane. You'll quickly recognize why State Farm is one of the leading providers of small business insurance.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Spencer Lane

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.